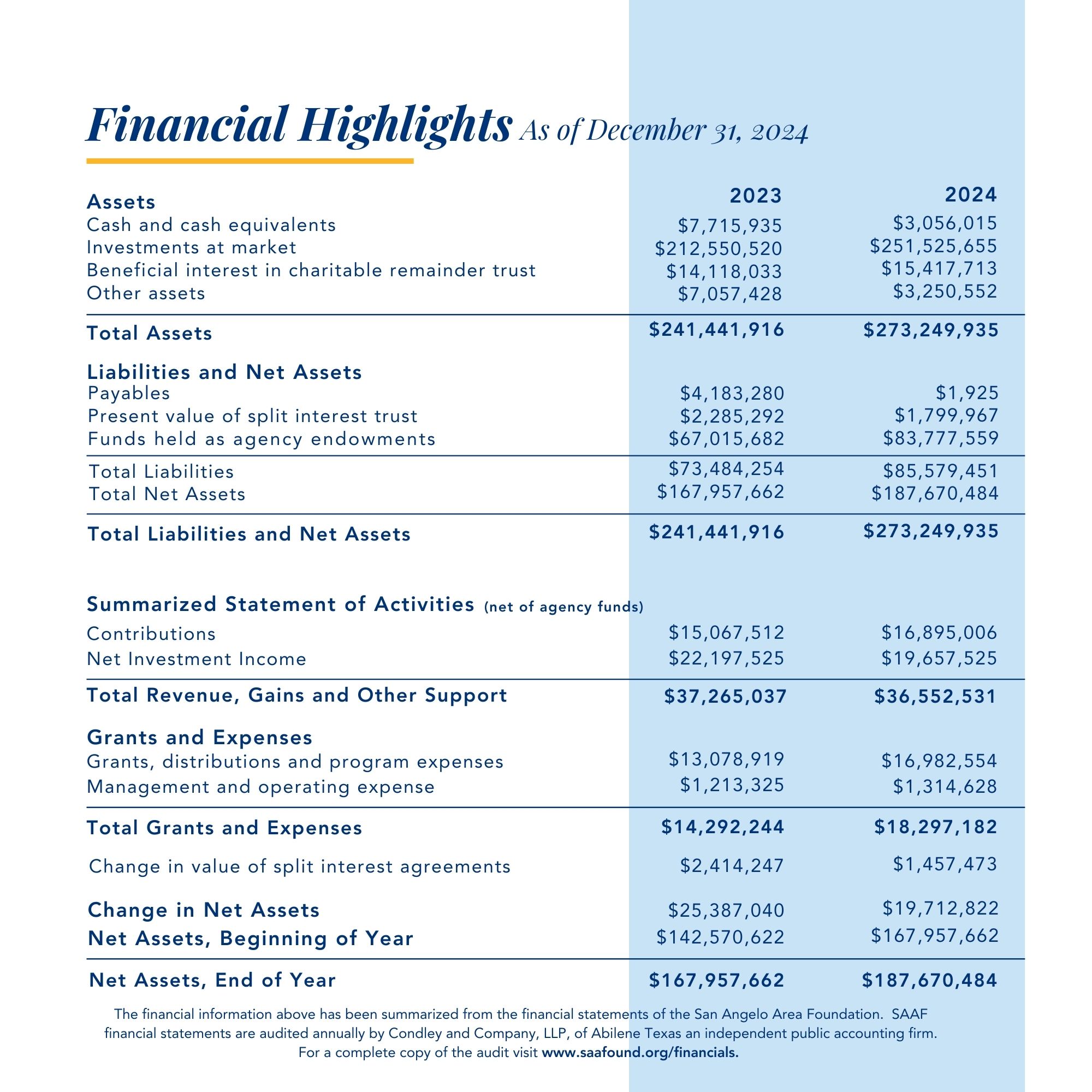

This financial information has been summarized by the Foundation from the financial statments of the San Angelo Area Foundation. The Foundation is audited by the independent public accounting firm of Condley and Company, LLP., of Abilene, Texas. Click here for a copy of the 2024 Audit, which is the most recent completed audit.

This Foundation files form 990 with the IRS annually and the latest copy is available by clicking here. The Foundation does not have earned income requiring the filing of form 990-T, thus the Foundation has never filed form 990-T. Should the Foundation ever file form 990-T, this form will also be available for public inspection.